Cash Reporting (Form 8300): Letters to Customers due Jan. 31

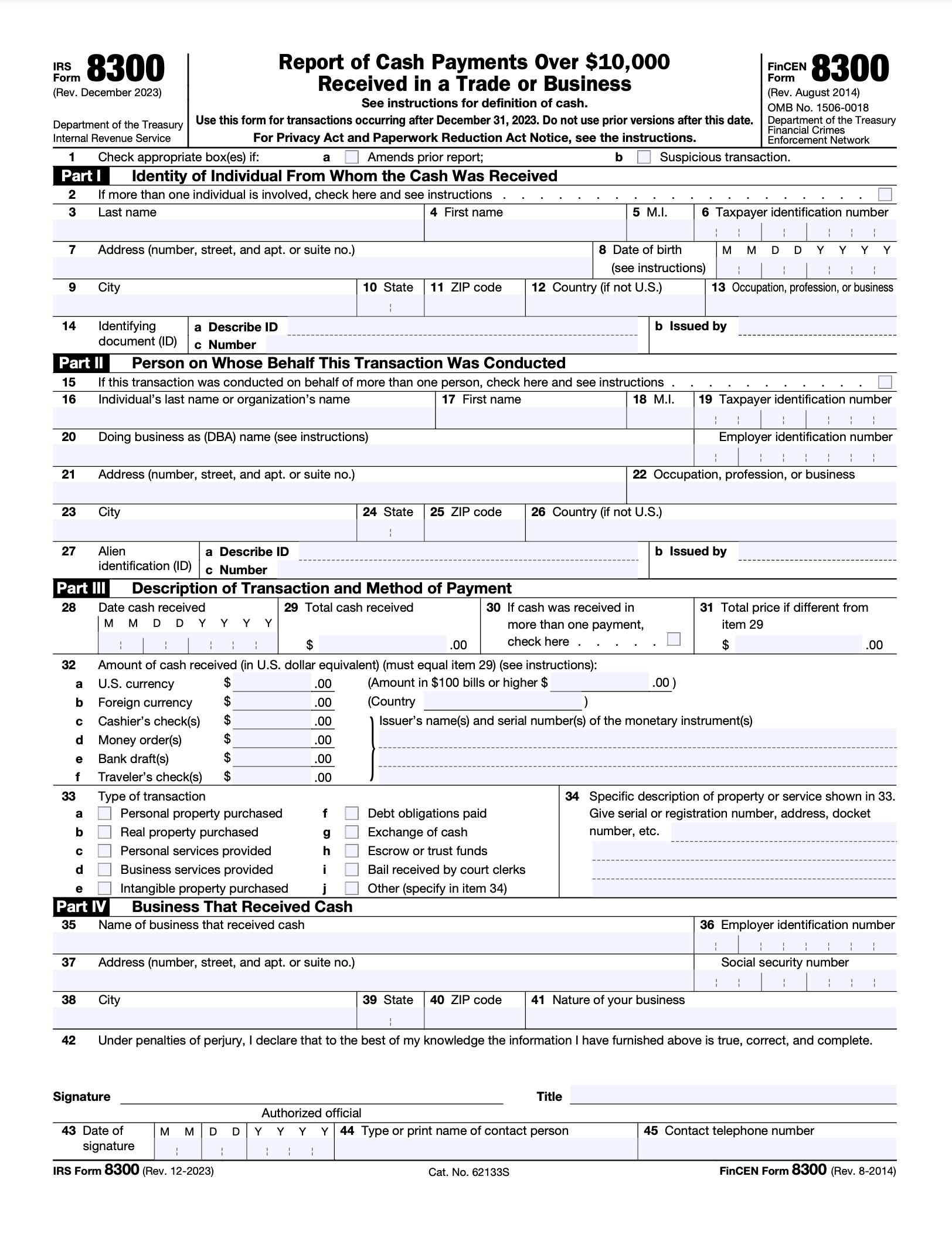

The IRS mandates the use of Form 8300 to report cash payments exceeding $10,000 received in a single transaction or related transactions in trade or business.

PARTNER SPOTLIGHT

F & I/Aftermarket Products, Insurance, Automotive Technology Training & Compliance

A NHADA Diamond PARTNER

A NHADA Diamond PARTNERDealer Management System, Computer Technology, Media/Advertising, Automotive Auction, F & I/Aftermarket Products, Automotive Technology Training & Compliance

A NHADA Platinum PARTNER

A NHADA Platinum PARTNERComputer Technology, Automotive Shop Equipment, Environmental Services

A NHADA Platinum PARTNER

A NHADA Platinum PARTNERF & I/Aftermarket Products, Automotive Technology Training & Compliance, Environmental Services

.png?width=150&name=corp_logo_horz_on_light_with_trademark_symbol_1200w%20(002).png) A NHADA Diamond PARTNER

A NHADA Diamond PARTNERA business must file Form 8300 to report cash paid to it if the cash payment is:

- Over $10,000;

- Received as one lump sum of over $10,000, or two or more related payments received within a 12-month period that total exceed $10,000

- Received in the course of trade or business;

- Received from the same buyer (or agent); and

- Received in a single transaction or in two or more related transactions.

Under the IRS rules, a business must notify its customers, in writing, by January 31 of the subsequent calendar year that the business has filed a Form 8300 regarding the cash transaction with the customer. (If a letter was sent to the customer at the time of the transaction and the filing of Form 8300, a second letter is not required.) Neither the code nor the regulations mandate a specific format for the customer letter; the regulations, however, do require the following minimum requirements in the letter:

- The name and address of the dealership and a contact person there submitting the Form 8300;

- The aggregate amount of reportable cash, received by the dealership filing the Form 8300 during the calendar year, in all related cash transactions;

- A statement that the information contained in the letter is being reported to the IRS.

As an alternative to filing the paper Form 8300, businesses may file electronically Form 8300 using FinCEN's Bank Secrecy Act (BSA) Electronic Filing System. E-filing can be done at no charge, and it is a quick and secure way for individuals to file their Form 8300s. Filers receive an electronic acknowledgment of each submission. To receive more information, visit the BSA E-Filing System here.

Additional information regarding Form 8300, including industry-specific scenarios like the one below, can be found below:

A customer purchased a vehicle for $9,000 cash. Within the next 12 months, the customer paid the dealership additional cash of $1,500 for a repair to the vehicle's transmission, accessories and a customized paint job, etc. Should a Form 8300 be filed?

- No, unless the dealer knew or had reason to know the sale of the vehicle and the subsequent transactions were a series of connected transactions (for example, if the dealer and the customer agreed, as a condition of the sale of the vehicle, that the customer would be obligated to buy an additional $1,500 of goods or services).

- Transactions are related if they occur within a 24-hour period. Transactions are related even if they are more than 24 hours apart if you know, or have reason to know, that each is one of a series of connected transactions. For example, items or services negotiated during the original purchase are related to the original purchase.

More scenarios via irs.gov are available here.

Fillable Form 8300 (Download)

Please Note: If you have questions, NHADA has several CPA partners who offer financial services to members, including:

.png?width=150&name=Ally_Final%20Logos%20and%20Pairings_11.14.2018-01%20(2).png)

-2.png?width=150&name=Wipfli%20Logo%20Blue%20RGB%20(1)-2.png)

.jpg?width=150&name=NHADA_Partner_FTR_Img_NHADA_Insurance%20(1).jpg)

.jpg?width=150&name=NHADA_Partner_FTR_Img_JMA(1).jpg)