Earn Tax Credits, Contribute To Worthy Cause

We're presenting you with the unique opportunity to make a contribution to the Black Heritage Trail of New Hampshire and earn Community Development Finance Authority (CDFA) Tax Credits, all in one fell swoop.

PARTNER SPOTLIGHT

Dealer Management System, Computer Technology, Media/Advertising, Automotive Auction, F & I/Aftermarket Products, Automotive Technology Training & Compliance

A NHADA Gold PARTNER

A NHADA Gold PARTNERComputer Technology, Automotive Shop Equipment, Environmental Services

A NHADA Platinum PARTNER

A NHADA Platinum PARTNERF & I/Aftermarket Products, Automotive Technology Training & Compliance, Environmental Services

.png?width=150&name=corp_logo_horz_on_light_with_trademark_symbol_1200w%20(002).png) A NHADA Diamond PARTNER

A NHADA Diamond PARTNERAbout the Black Heritage Trail of New Hampshire:

The Black Heritage Trail of New Hampshire was established in 2016 to promote awareness and appreciation of African American history and culture in New Hampshire and received non-profit status in 2017. However, the work began in 1994 by the Portsmouth Black Heritage Trail which now has 30 Portsmouth sites and provides the ideal foundation for a statewide expansion that fosters deeper research into a truer and more complete understanding of NH history.

Tax Credit Program Overview:

The New Hampshire Community Development Finance Authority awards approximately $5 million in tax credits annually to nonprofits throughout New Hampshire. The funds have a significant impact on community and economic development initiatives across the state with projects ranging from downtown revitalization and job creation efforts to increasing access to affordable housing and addiction recovery services.

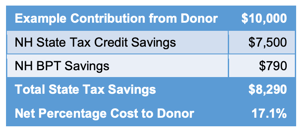

Grants made to these organizations by CDFA are in the form of tax equity. New Hampshire businesses support the selected projects by purchasing the tax credits, resulting in the nonprofit receiving a donation and the company receiving a 75 percent New Hampshire state tax credit against that contribution. The credit can be applied against the Business Profits Tax, Business Enterprise Tax or Insurance Premium Tax.

Criteria for Funding Tax Credit Projects

All Tax Credit projects are subjected to substantial programmatic and financial review. Among other requirements, projects must provide a clear public benefit and demonstrate that similar funding was not otherwise available. Funding recommendations are made by an Investment Review Committee that includes a combination of CDFA Board members and staff. As a result of the highly competitive and rigorous review process, CDFA’s Tax Credit program funds projects which demonstrate project readiness and viability, as well as deliver measurable outcomes.

How Businesses Can Participate in the Tax Credit Program

New Hampshire businesses value this unique state program which incentivizes and rewards public- private partnerships to fund local community economic development. As a result of participating in the Tax Credit program, a business’s donations stay in their communities and help establish strong relationships with local non-profits. For example, a business can make a $10,000 impact on the local community for a net cost of approximately $1,710.

.png?width=150&name=Ally_Final%20Logos%20and%20Pairings_11.14.2018-01%20(2).png)

-2.png?width=150&name=Wipfli%20Logo%20Blue%20RGB%20(1)-2.png)

.jpg?width=150&name=NHADA_Partner_FTR_Img_NHADA_Insurance%20(1).jpg)

.jpg?width=150&name=NHADA_Partner_FTR_Img_JMA(1).jpg)